In the ever-evolving world of industry, we understand that every investment matters. As your trusted partner for conveyors, dust suppression systems, mini dumpers, and site safety equipment, InterQuip is committed to not only providing top-tier solutions but also ensuring that you get the most value from your investments. In this spirit, we’d like to shed light on a game-changing opportunity that directly impacts you – Section 179 of the Internal Revenue Code (IRC).

The Magic of Section 179:

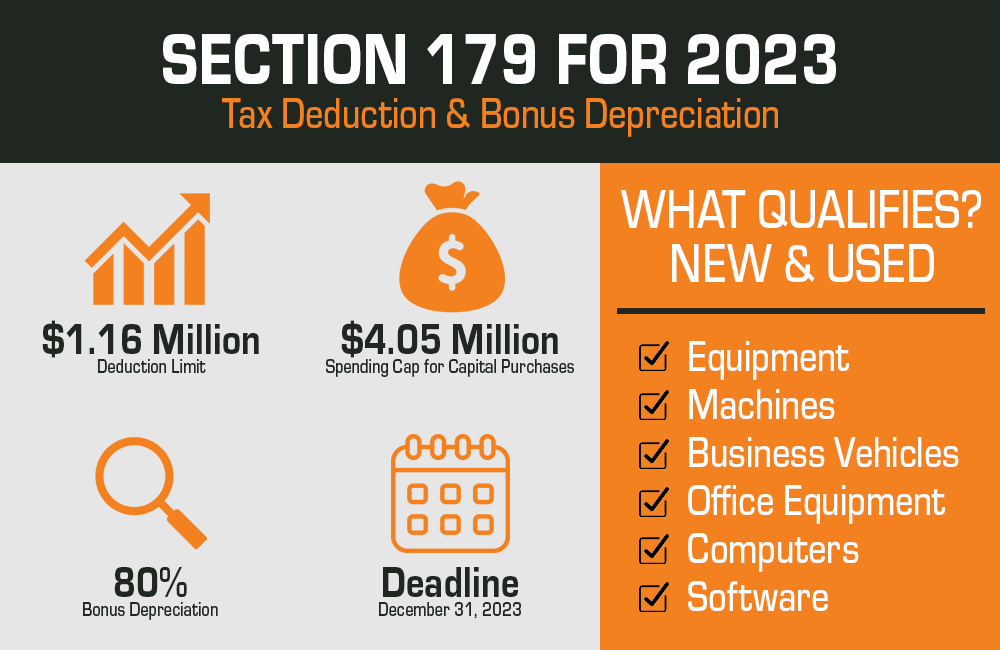

Section 179 is not just another tax provision; it’s a key that unlocks immediate benefits for your business. This provision allows you, our valued customers, to deduct the full purchase price of qualifying equipment and software during the tax year, instead of spreading the cost over several years. This means you can invest in the equipment you need today and reap the tax benefits right away.

Immediate Deduction for Your Investment:

Whether you’re eyeing our conveyors, dust suppression systems, mini dumpers, or site safety equipment, Section 179 is your ticket to immediate deductions. Traditionally, businesses would wait for years to recoup expenses, but not anymore. With Section 179, you can deduct the entire cost of your essential equipment in the same year you make the purchase.

A Year of Opportunity:

Exciting news awaits you! The Section 179 deduction limit has been raised to $1,160,000 – that’s an $80,000 increase from last year. What does this mean for you? You can now deduct the entire cost of qualified equipment, up to a total equipment purchase limit of $2.8 million. This enhanced deduction limit is our way of empowering you to make significant investments in cutting-edge equipment without delay.

Empowering Your Growth and Innovation:

Beyond tax savings, Section 179 puts the power back in your hands. The immediate deduction translates to improved cash flow, allowing you to reinvest in your business, enhance your operations, and stay at the forefront of innovation. InterQuip is not just selling equipment; we’re providing you with the tools to thrive and grow in your industry.

Making the Most of Section 179:

- Stay Informed: Keep an eye on updates to Section 179 limits and eligibility criteria to make informed decisions about your equipment purchases.

- Plan Strategically: Work with your financial advisors to strategically plan your equipment investments, aligning them with your business’s growth trajectory.

- Keep Good Records: Maintain detailed records of your equipment purchases and related expenses to maximize your tax benefits.

- Explore Financing Options: Consider financing alternatives that align with your financial goals, taking into account the immediate deductions offered by Section 179.

At InterQuip, our commitment goes beyond providing top-quality equipment – it’s about empowering your success. With Section 179, the Internal Revenue Code is opening doors for you to invest wisely, grow confidently, and innovate fearlessly. The increased deduction limit in 2023 is a valuable opportunity provided by the tax code, and we’re here to help you make the most of it. Let’s unlock a world of possibilities together and make this year a milestone for your business.

2023 Section 179 Example Calculation

($1,160,000 maximum in 2023)

(20% in each of 5yrs on remaining amount)

($1,160,000 + 32,000 + 0)

($1,192,000 x 35% tax rate)

(assuming a 35% tax bracket)

This information is for demonstrative purposes only and is not intended to provide tax or legal advice.

Please consult your financial advisor or tax attorney.